Reinvent Your Insurance Company with an Agile Customer Communication Platform

Competition, operational costs, and supply-chain disruptions have put insurance companies on their heels. They need to reinvent themselves to meet customer expectations and deliver an exceptional customer experience from start to finish.

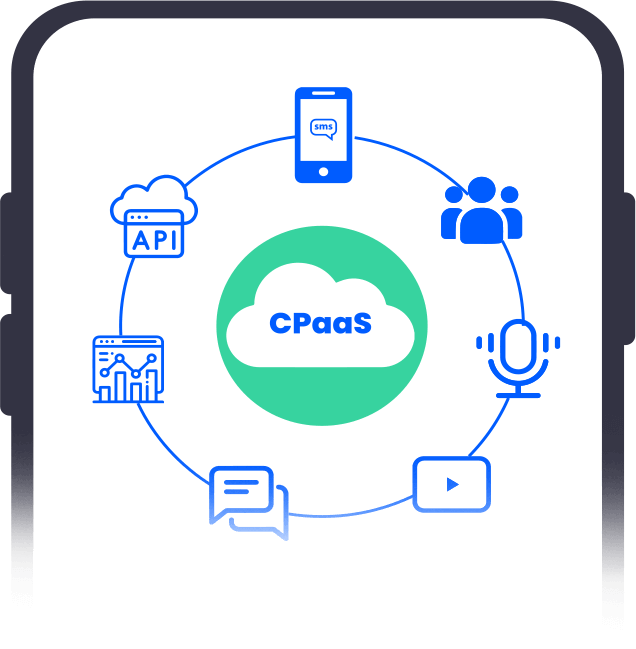

With its roster of cloud-based communication APIs, Nudge can seismically impact your customer communication experience and operations. Our omnichannel CPaaS solution includes SMS, WhatsApp, email, chatbots, IVR, and more communication capabilities that relieve administrative bloat while enhancing customer satisfaction.

Buying a policy, assistance in ongoing purchases, creating online payment portals, customer service, receipts and statements, claim requests, loans against policies, and all the other pieces of the insurance cycle are at your fingertips.

How Nudge’s Omnichannel Customer Communication Helps Your Insurance Company

Make Insurance Renewal a Cakewalk

A frictionless renewal process will more likely increase your chances of policy renewal, and remember, selling to existing customers is always easier than finding a new prospect.

Nudge’s CPaaS enables you to assess quickly, send links for on-time renewal requests, or allow auto-renewal without lengthy paperwork and manual verifications.

Eliminate the risk of no-shows in appointments with SMS & WhatsApp

Programmable SMS APIs from Nudge can be a game changer for your business, enabling automated SMS reminders and notifications for booking customer appointments. Now, rule out the risk of no-shows by scheduling reminders for your customers for policy purchases, renewals, and other advisory services.

Eliminate the risk of no-shows in appointments with SMS & WhatsApp

Programmable SMS APIs from Nudge can be a game changer for your business, enabling automated SMS reminders and notifications for booking customer appointments. Now, rule out the risk of no-shows by scheduling reminders for your customers for policy purchases, renewals, and other advisory services.

Set your agents free while increasing operational efficiency with IVRS

Deploy the most commonly implemented self-service functionality of the CPaaS umbrella, IVRS, for your simple yet repetitive queries and transactions.

IVR can conveniently let your customers call in and listen to claim status, pay-out amounts, pay-out dates, and other crucial details, trimming off the waiting and call time.

Now, set your agents free for more complex tasks and appointments.

Enable Insurance Claims On-the-Go

Our instant communication tools like email, SMS, or WhatsApp help your claimant bypass the tedious manual process of documentation and claim by digitally establishing instant communication with you.

Embed new and convenient features in your app and make your claim process glide seamlessly, saving your resources and time.

Enable Insurance Claims On-the-Go

Our instant communication tools like email, SMS, or WhatsApp help your claimant bypass the tedious manual process of documentation and claim by digitally establishing instant communication with you.

Embed new and convenient features in your app and make your claim process glide seamlessly, saving your resources and time.

Empower your customers

Provide instant support to your customers in need through conversational messaging channels for faster case resolution without waiting in long queues.

Reduce your inbound call volume and inquiries by implementing prompt updates and notifications.

Why Nudge CPaaS for Your Insurance Company?

• No need to rebuild. Our platform sits on your existing tech stack and integrates with most ERPs.

• Interact with customers at scale. Intelligent automation and multichannel capabilities allow you to communicate with your customers even as you grow.

• Unified platforms. Enjoy a centralized, low-code platform offering a unified view and one interface for customer interaction.

• Automate customer chats. Our chatbots use natural language processing to manage peaks in call volume and offer customers a self-service option.

• Compliant and Secure. We take security seriously and ensure regulatory compliance with regional laws and measures to protect customer data.

• No need to rebuild. Our platform sits on your existing tech stack and integrates with most ERPs.

• Interact with customers at scale. Intelligent automation and multichannel capabilities allow you to communicate with your customers even as you grow.

• Unified platforms. Enjoy a centralized, low-code platform offering a unified view and one interface for customer interaction.

• Automate customer chats. Our chatbots use natural language processing to manage peaks in call volume and offer customers a self-service option.

• Compliant and Secure. We take security seriously and ensure regulatory compliance with regional laws and measures to protect customer data.

At Nudge, we help our customers fast-track CPaaS solutions so that their businesses can benefit from real results.

Schedule a demo today to get a real-time experience of how Nudge can help your insurance company!

Product

Nudge

tilliX

tilliPay

Industries

Utilities

Banking & Finance

Telecommunications

And more...

Company

About Us

Careers

Services

Resources

Case Studies

Blog

Support

Request a Demo

Start Free Trial

Contact

Developers

tilliPay

Documentation

API Reference

Nudge

Documentation

API Reference

Follow Us On Social:

Product

Nudge

tilliX

tilliPay

INDUSTRIES

Utilities

Banking & Finance

Telecommunications

And more...

Company

Services

Resources

Case Studies

Articles

Support

Request a Demo

Start Free Trial

Contact

Developers

tillipay

Documentation

API Reference

Nudge

Documentation

API Reference

Follow Us On Social

Shabbir Gilani

Shabbir Gilani

Shahid Husain

Shahid Husain Raja Gopal Vemuri

Raja Gopal Vemuri Ali Saberi

Ali Saberi