Ever wondered how businesses process their payment transactions so conveniently and with such agile processing? That answer is payment facilitators – leaders who are changing the game in the payment space. Without further ado, let us take a look at some of the most interesting stats:

- Until 2025, the Payment Facilitator market is forecasted to grow at a CAGR of 31.8%.

- The PayFac market produced $2 billion in transaction revenue in 2018, growing to $15 billion by 2025

- There are anticipated to be over 4,200 Payment Facilitators around the world by 2025.

Source Infinicept

These numbers illustrate the importance of the digital payments ecosystem and highlight the rapid rise of Payment Facilitators. So, what is a Payment Facilitator exactly and how does it add value to my business?

What is a Payment Facilitator or a PayFac?

A PayFac, short for Payment Facilitator, is a service provider that provides businesses with the means to accept electronic payments by customers. A PayFac provides a simple way for merchants (sub-merchants) to accept payment as an intermediary between merchants and payment processors. They simplify the process of onboarding sub-merchants, lowering the time and effort required to begin accepting payments. Most PayFacs provide an integrated platform for transaction processing, risk management and settlement.

This structure helps to ensure a faster and easier payment experience for both businesses and their customers, as businesses will never have to handle the complexity of setting up their own merchant accounts. Instead they use the PayFac’s infrastructure, benefiting from faster onboarding, simpler underwriting and consolidated reporting.

Learn More About Monay Payment System

What is the meaning of Payment Facilitation?

A Payment Facilitator (PayFac) is an intermediary that provides a one-stop-shop solution that enabling payments or transactions between customers and businesses. Some details of payment facilitation are:

- Integrated Payments: The convenience of one-channel payment facility

- Sub-Merchant Onboarding: Direct merchant accounts can be very hard to open.

- Risk Management: Underwriting and fraud prevention are put in place to manage risk around payments.

- Aggregated Payment Processing: Consolidating transactions from multiple sub-merchants, simplifying settlement and reporting.

- Value-Added Services: Offering reporting, analytics, customer support, and integration assistance

- Scalability and Flexibility: Allowing businesses to scale their operations without extensive infrastructure development.

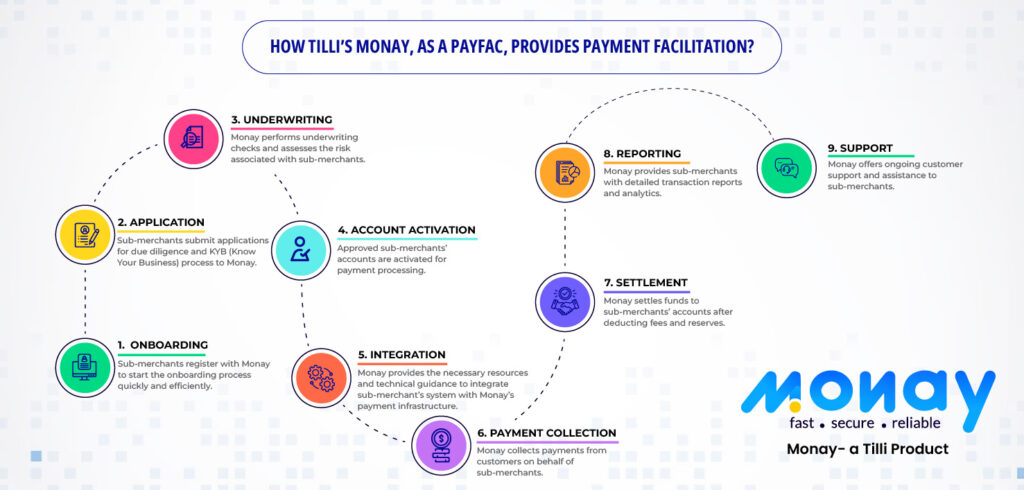

How Monay, As a PayFac, Provides Payment Facilitation?

Monay is a Payment Facilitator you can trust to make your payment process simple and convenient. Monay provides end-to-end features, such as seamless onboarding, diverse payment methods, enhanced security, and scalability. Monay: With multiple payment modes and ultimate convenience, Monay – a Payment Facilitator company ensures that businesses comply with regulations and policies.

Benefits of PayFac for the Merchants

- Faster and simpler payments: Enhanced onboarding enables merchants to seamlessly begin accepting payments.

- Lower Complexity: PayFacs support a lot of complexity like underwriting, compliance, and payment processing.

- Cost Saving: This eliminates the cost of having their own merchant accounts set up.

- Improved Payment Experience: PayFacs provide a unified payment experience, enhancing customer satisfaction.

- Scalability: PayFacs offer scalable solutions that grow alongside the business, improving their payment processing capacity.

Partnering with a PayFac allows merchants to focus on their core business while leaving payment processing in capable hands.

How to Choose the Best PayFac (Payment Facilitator)?

It is therefore imperative to have Payment Facilitator company selection. Keep the following in mind:

Here are a few factors to consider:

- Industry Experience: It needs experience in your industry.

- Two-way integration: Verify seamless integration with current systems.

- Authorised Payment Methods: Confirm that the PayFac supports the payment methods you favour.

- Make Sure Uses Security Measures: Make sure the PayFac uses security measures.

- Pricing Structure: Know the PayFac’s pricing model.

- Quality of Customer Support: Consider how good the customer support is.

- Scalability and Growth: Ensure the PayFac can scale with your business.

Discover Monay from Tilli Software: A Trusted and Leading Payment Facilitator

Welcome to Monay, the trusted Payment Facilitator by Tilli Software. Monay is committed to making payment processes straightforward. This has been one of the major reasons how Monay, the leading PayFac is thriving while offering the business with a lot many features that suit the need of the organization. Let Monay your partner in payments.

From streamlined onboarding and comprehensive payment options to robust security measures and scalable solutions, Monay offers a comprehensive suite of features that make it one of the best payment facilitators in the market.

If you’re seeking a Payment Facilitator that prioritizes compliance with regulations and policies, your search ends with Tilli’s Monay. Offer your users multiple payment modes along with ultimate convenience.

Let us be your trusted partner in navigating the world of payments!

Shabbir Gilani

Shabbir Gilani

Shahid Husain

Shahid Husain Raja Gopal Vemuri

Raja Gopal Vemuri Ali Saberi

Ali Saberi